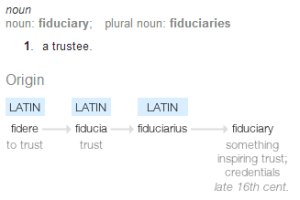

• Fiduciary noun. From the Latin fiducia, meaning “trust,” a person (or company) who has the power and obligation to act for another under circumstances which require total trust, good faith, and honesty. (Free Dictionary)

As a registered investment adviser, we work as a fiduciary when we give advice and manage money.

We often try to approach our blog topics with a light touch and a sense of fun. We believe a little humor helps us communicate important financial issues more effectively. With this in mind, we think many people often feel that having to deal with financial matters is like having to visit the dentist – it may be necessary but not exactly something to look forward to. No disrespect meant to our dentist friends. They understand.

This article, however, is about something we take very seriously: Our fiduciary obligation to you, our client. Put simply, a fiduciary duty is the duty to put your interests ahead of our own in everything we do. It’s a legal standard we follow, but in our view, also a moral obligation we willingly accept.

Not all financial advisors are fiduciaries. As a matter of fact, the majority aren’t.

Registered investment advisory firms are held to a fiduciary standard. Acting as a fiduciary is one of the main reasons we chose to work in this capacity as opposed to a registered representative – commonly known to as a stockbroker. While managing your money as a registered investment advisor requires more effort from us, the extra effort is worth it to assure our clients their financial issues are being looked after with the care they deserve.

Let us put it this way: If we were looking to hire a financial advisor for someone we loved, we would only hire a registered investment adviser.

By law, a fiduciary is required to act solely in the best interest of the client. They must fully disclose any conflict, or potential conflict to the client prior to and throughout a business engagement. What does acting as a fiduciary mean to our clients in the day-to-day operation of our practice? Here’s a good example: We disclose completely any conflicts of interests that may affect our decision-making on your behalf. So if we were compensated for referring you to our favorite dentist – we aren’t – we would need to let you know in writing. This disclosure, along with information about our services, is an important part of our Firm Brochure (Form ADV Part 2). Our brochure is available to all our clients at our office, upon request over the phone or through e-mail. You can also find this information on any U.S. registered investment advisers by visiting www.adviserinfo.sec.gov.

This brochure/disclosure is a good example of what being a fiduciary is all about (and something you won’t get from most of our competitors). It contains all the information you need to understand how we conduct our business, our investment philosophy, our experience, business and educational background, our firm’s Code of Ethics, and more. While it is a rather lengthy document that might induce drowsiness and help you get to sleep if you read it in bed, you’ll understand the extent to which we are providing full disclosure about our practice.

We want you to know, before all else, we conduct our business with honesty, in good faith and with a standard of care that places your best interests at the forefront of all we do. We are proud to support the Fiduciary Standard in every aspect of serving our clients.

Author: Callahan Financial Planning

Callahan Financial Planning is an independent fiduciary financial advisory firm, providing planning on a fee-only basis, without sales commissions, with offices in San Rafael, San Francisco, and Mill Valley in Northern California, in Omaha and Lincoln in Nebraska, and in the Denver metro area in Centennial Colorado.